Duration 17:57

Narrow Range Stock Selection - TTM Squeeze Strategy (HINDI)

Published 1 Sep 2018

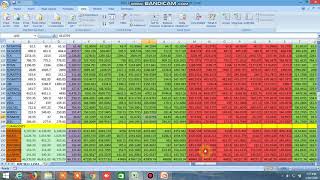

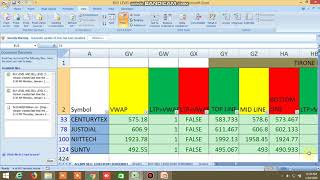

Narrow Range Stock Selection is key to breakout strategy. The TTM squeeze can help the investors or traders to find out Narrow Range Stocks in just 2 mins. TTM Squeeze is a combination of Bollinger Bands and Keltner Channel. Besides narrow range, i consider 2 other important criterion i.e. the stock should be high beta stock along with very high volatility. The squeeze is formed when the Bollinger band cross inside the Keltner channel and breakout or breakdown is reverse of the same. There is a 70% to 80% overlap between the narrow range stocks selected through NR4 and NR7 stocks & the stocks selected through the TTM Squeeze strategy. Keltner channel indicator is based on the ATR or True Range i.e. it is a Volatility based indicator. It is narrow than Bollinger band. The Bollinger band squeeze is relative. However, a combination of two is more reliable. This strategy works for both Intraday trading and Swing Trading or even for long term investment. The time frame for intraday trading is 15 mins and for swing trading, i consider the daily charts. You can backtest or paper trade before any investment or trading based on Narrow Range Stock Selection through TTM Squeeze Strategy. If you liked this video, You can "Subscribe" to my YouTube Channel. The link is as follows https://goo.gl/nsh0Oh By subscribing, You can daily watch a new Educational and Informative video in your own Hindi language. For more such interesting and informative content, join me at: Website: http://www.nitinbhatia.in/ T: http://twitter.com/nitinbhatia121 G+: https://plus.google.com/+ NitinBhatia #NitinBhatia #NarrowRange #TTMSqueeze

Category

Show more

Comments - 1438